New and Noteworthy

The Importance of Demonstrating FQHC Value and Impact

Newly released reports show that patients are benefitting from the changing landscape of community health centers. Monitoring this data is essential for FQHCs to maintain financial sustainability, as it justifies funding support, educates stakeholders, and helps narrate a health center’s story.

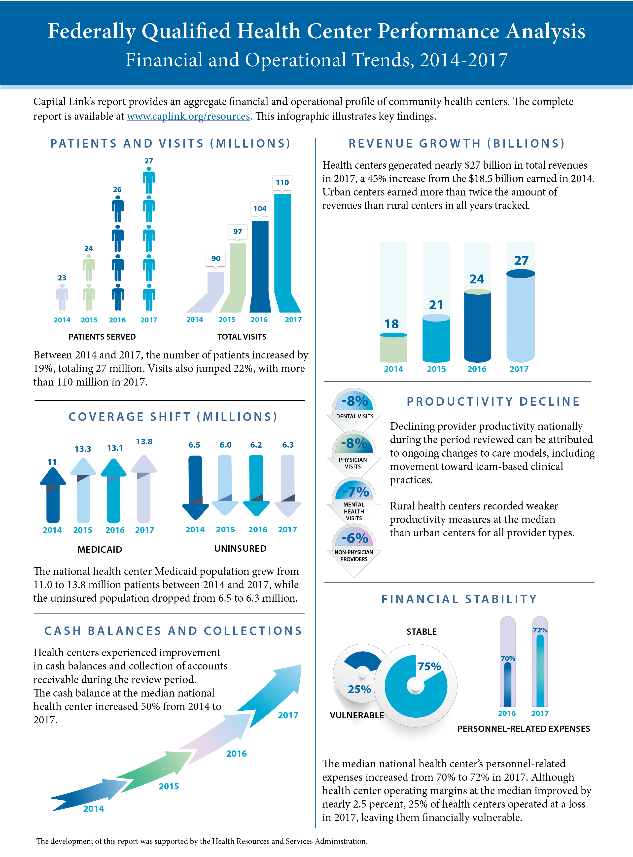

Capital Link’s recently released FQHC Financial and Operational Performance Analysis report and infographic highlight health center strengths, challenges, and opportunities for performance improvement between 2013 and 2017.

According to the report, health centers generated nearly $27 billion in total revenues in 2017, a 45% increase from 2014. During the review period, the number of patients served nationally increased 19%, totaling 27 million. Visits also jumped 22%, with more than 110 million in 2017.

A survey by The Commonwealth Fund reports FQHCs made substantial strides in access to care, technology, and innovation between 2013 and 2018. Expanding access to timely care has been shown to reduce emergency department visits, increase patient satisfaction, and reduce unmet medical need.

In terms of advancing technology, nearly all health centers now use an electronic health record (99% vs. 93% in 2013), and the percentage of health centers leveraging technology to improve care has increased. More health centers are also now engaged in innovative models of care – the proportion of health centers recognized as a patient-centered medical home rose substantially (84% vs. 35% in 2013).

According the 2019 Fact Sheet by the National Association of Community Health Centers (NACHC), FQHCs serve over 13 million people in poverty, 1.4 million homeless patients, and more than 385,000 veterans per year. In addition to providing necessary care to America’s most underserved communities, NACHC reports that FQHCs also save the health care system $24 billion annually. At $2.09 per day, the health center average daily cost per patient is lower than physicians ($3.06) and they save more than $2,300 per Medicaid patient.

25th Anniversary Highlights: The Impact of Capital Link and Capital Fund

Back in 1992, when the idea first hatched for developing a company providing assistance to health centers for capital expansion projects, there were about 575 health centers nationally serving about 6.8 million patients. Fast forward to now: there are almost 1,400 corporate entities serving more than 28 million patients.

The scope of health centers serving communities has expanded, and so has Capital Link and Capital Fund’s impact. To date, Capital Link and Capital Fund have provided assistance to more than 900 health centers, helping them deploy $3 billion in federal capital grants and directly assisting centers in planning and leveraging $1.2 billion in financing for hundreds of capital projects totaling more than $1.5 billion.

Today, 25 years after its inception, Capital Link continues to provide training and technical assistance to health centers related to capital development and growth planning, with a strong emphasis on developing financially strong, viable health centers.

The HRSA Health Center Facility Loan Guarantee Program - Updates

Originally authorized by Congress in 1997, the HRSA Loan Guarantee Program (LGP) offers loan guarantees for the construction, renovation, and modernization of medical facilities operated by health centers. Authorized under Part A of Title XVI of the Public Health Service Act, the guarantee can cover up to 80% of the principal amount of loans made by non-federal lenders. In 2018, Congress appropriated new funds for the program, enabling HRSA to update and modernize it to provide guarantees for almost $900 million in loans to health centers going forward.

The purpose of a loan guarantee is to enhance the health center’s credit profile, reducing the lender’s risk and allowing it to lend to health centers under more favorable terms than would have been possible otherwise. For some centers, a loan guarantee could mean the difference between getting a “yes” versus a “no” from a lender, while for others, it may allow the lender to offer a lower interest rate, a longer fixed-rate term, or a loan-to-value ratio, or other benefits.

|

. |

HRSA LGP applications are now being accepted. Interested health centers should contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Visit https://bphc.hrsa.gov/programopportunities/loan-guarantee-program.html for details or contact Capital Link for assistance.

Access the slides and recordings of our recent LGP webinars:

Health Center Capital Project Financing Sources:

HRSA’s Loan Guarantee Program and NMTC

Slides | Recording

Demystifying HRSA’s Loan Guarantee Program:

Two-part webinar series sponsored by NACHC:

Part I: HRSA's Loan Guarantee Program Explained

Presenter: Allison Coleman, CEO

Slides | Recording

Part II: HRSA's Loan Guarantee Program Q&A

Presenters: Allison Coleman, CEO, and Capital Link Health Center Advisory Services team members

Slides | Recording

Please continue to check Capital Link’s website and HRSA’s LGP webpage for new information on the program as it becomes available.